In today’s digital world, cybersecurity is crucial. The Digital Operational Resilience Act (DORA) is a vital regulation designed to strengthen cybersecurity across the European Union’s financial sector. It establishes a unified regulatory standard to ensure financial entities across the EU maintain consistent cybersecurity levels, reducing the risk of widespread cyber incidents.

Iterasec specializes in helping organizations navigate the complexities of regulatory compliance. Our experienced team is skilled at managing the requirements of the DORA Act, ensuring your organization is compliant and resilient against evolving threats.

This article will explore the Digital Operational Resilience Act (DORA), covering its key components, current status, and implementation timeline. Additionally, we will discuss the benefits of DORA compliance, the challenges and considerations for its implementation, provide a summary for CIOs and CISOs, and offer practical guidance on preparing for the DORA legislation. We aim to equip you with the knowledge and insights necessary to navigate the DORA compliance journey effectively.

Stay with us as we unpack the critical aspects of the Digital Operational Resilience Act (DORA) and its implications for your organization.

What is DORA?

Financial entities can better prepare for the challenges of Digital Operational Resilience Act implementation and ensure compliance with this critical legislation by understanding what DORA is and its key components.

Definition of DORA Regulation

The Digital Operational Resilience Act (DORA) is an EU regulation aimed at ensuring the stability and security of the financial sector’s digital infrastructure. DORA sets forth a comprehensive framework for managing and mitigating cyber risks, mandating that financial entities implement robust cybersecurity measures to protect their operations and data from cyber threats.

Objectives of DORA Regulation

The primary goals of DORA are to enhance financial entities’ cybersecurity posture and to ensure a consistent level of resilience across the sector. Key objectives include:

- Strengthening cybersecurity: DORA requires financial entities to adopt advanced cybersecurity practices, including continuous monitoring and rapid response to cyber incidents.

- Improving operational resilience: The regulation mandates that organizations develop comprehensive strategies to maintain operations during and after a cyber incident, minimizing disruption.

- Standardizing regulatory requirements: DORA aims to harmonize cybersecurity standards across the EU, ensuring that all financial entities adhere to the same high level of security and resilience.

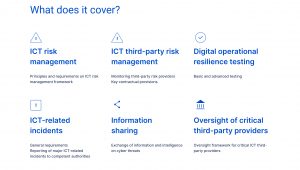

Key Components of the Digital Operational Resilience Act

The DORA Act consists of several critical elements designed to bolster digital resilience within the financial sector:

- Risk Management: Financial entities must establish robust risk management frameworks to identify, assess, and mitigate cyber risks. It includes regular threat assessments and implementing controls to address identified vulnerabilities.

- Incident Reporting: DORA mandates timely reporting of significant cyber incidents to regulatory authorities. It ensures that incidents are promptly addressed and lessons learned can be shared across the sector.

- Operational Continuity: Organizations must develop and maintain detailed plans to ensure the continuity of critical operations during and after a cyber incident. It includes disaster recovery and business continuity planning.

- Third-Party Risk Management: DORA requires entities to manage risks associated with third-party service providers, ensuring that their cybersecurity standards are aligned with those of the financial entity.

- Testing and Assurance: Regular testing of digital operational resilience, including Threat Led Penetration Testing (TLPT), is mandated to identify and address potential vulnerabilities in an organization’s infrastructure.

What is the current status of the Digital Operational Resilience Act (DORA)?

The Digital Operational Resilience Act (DORA) is an EU regulation that entered into force on 16 January 2023 and will apply as of 17 January 2025. This regulation aims to strengthen the IT security of financial entities such as banks, insurance companies, and investment firms, ensuring that the financial sector in Europe remains resilient in the event of severe operational disruptions.

Recent Developments in DORA Implementation

- Legislative Milestones: Since DORA entered into force, key legislative bodies within the EU have worked on integrating its provisions into the operational frameworks of financial entities. The final text of the regulation has been published, marking a crucial step towards its enforcement.

- Guidance and Frameworks: Regulatory authorities have issued detailed guidelines to help financial entities understand and implement the DORA Act. These guidelines cover various aspects of the regulation, including risk management, incident reporting, and third-party risk management.

- Pilot Programs and Testing: Financial entities are conducting pilot programs to test their readiness for DORA compliance. These programs often involve Threat Led Penetration Testing (TLPT) to identify vulnerabilities and ensure robust cybersecurity measures are in place.

- Stakeholder Engagement: Regulatory bodies are actively engaging with stakeholders across the financial sector to facilitate a smooth transition to full compliance with the Digital Operational Resilience Act (DORA). Workshops, seminars, and consultations are being held to address concerns and provide support.

- Timelines for Compliance: Clear timelines have been established for different phases of DORA implementation. Financial entities must achieve compliance with various components of the act within specific deadlines, ensuring a structured and manageable transition.

Harmonization of Operational Resilience Rules

DORA brings harmonization of the rules relating to operational resilience for the financial sector, applying to 20 different types of financial entities and ICT third-party service providers. This unified approach ensures that all entities within the financial sector adhere to consistent and high standards of cybersecurity and operational resilience.

As the Digital Operational Resilience Act status continues to evolve, financial entities must stay informed about the latest developments. The implementation phase is well underway, with significant efforts being made to ensure that the financial sector is prepared for the full enforcement of DORA. This proactive approach helps in achieving DORA compliance and strengthens the overall cybersecurity posture of the financial industry.

We can help you navigate DORA implementation and ensure your organization remains secure and resilient against cyber threats.

Which organizations will be impacted by the Digital Operational Resilience Act?

The Digital Operational Resilience Act (DORA) applies to a broad range of financial entities and ICT third-party service providers, ensuring that a wide spectrum of the financial sector adheres to its strict cybersecurity requirements and operational resilience.

Types of Organizations Impacted by DORA

- Banks: As key players in the financial sector, banks are directly impacted by the DORA regulation. They must implement robust cybersecurity measures and ensure operational resilience to protect vast digital infrastructures.

- Insurance Companies: These entities must comply with DORA to safeguard sensitive customer data and ensure continuity of services during cyber incidents or operational disruptions.

- Investment Firms: Investment firms, including asset managers and brokers, are required to adhere to the DORA Act to mitigate risks associated with cyber threats and operational failures.

- Payment Service Providers: Entities involved in processing payments must comply with the Digital Operational Resilience Act (DORA) to ensure secure and uninterrupted transaction processes.

- Credit Rating Agencies: These organizations must meet the DORA compliance requirements to protect their critical data and maintain the integrity of their rating processes.

- ICT Third-Party Service Providers: DORA legislation extends to third-party service providers supplying ICT services to financial entities. These providers must align their cybersecurity practices with DORA’s standards to ensure the overall resilience of the financial sector.

- Trading Venues: Entities operating trading platforms must implement the necessary measures to comply with DORA, ensuring secure and resilient trading operations.

- Central Securities Depositories and Clearing Houses: These organizations play a crucial role in the financial market infrastructure and must adhere to the DORA regulation to maintain the stability and security of financial transactions.

- Electronic Money Institutions: Providers of electronic money services are required to comply with DORA to protect digital wallets and transaction data from cyber threats.

DORA’s comprehensive scope ensures that all critical financial sector components are fortified against cyber risks and operational disruptions. The EU aims to create a robust and resilient financial ecosystem by requiring a wide array of financial entities and ICT service providers to comply with the Digital Operational Resilience Act.

DORA Connections with Other EU Regulations

The Digital Operational Resilience Act (DORA) does not exist in isolation; it interacts with and complements several other EU regulations to create a cohesive and comprehensive framework for cybersecurity and operational resilience within the financial sector. Understanding these connections is crucial for organizations aiming to achieve full compliance and enhance their overall security posture:

- General Data Protection Regulation (GDPR): DORA complements GDPR by ensuring that financial entities not only protect personal data but also maintain the resilience of their IT systems. While GDPR focuses on data privacy and protection, the Digital Operational Resilience Act (DORA) emphasizes digital infrastructure security and continuous operation. Together, they provide a robust framework for data protection and operational resilience.

- Network and Information Systems (NIS) Directive: The NIS Directive aims to improve the cybersecurity capabilities of critical infrastructure operators across the EU. DORA builds on this foundation by setting specific requirements for financial entities, ensuring they are prepared to handle and recover from cyber incidents. The alignment between the NIS Directive and the DORA regulation ensures a harmonized approach to cybersecurity across various sectors.

- Markets in Financial Instruments Directive (MiFID II): MiFID II regulates trading activities within the EU, aiming to increase transparency and reduce systemic risks. DORA supports these goals by enhancing the operational resilience of trading venues and financial institutions. By complying with MiFID II and DORA, organizations can ensure the stability and integrity of financial markets.

- European Banking Authority (EBA) Guidelines: The EBA provides guidelines on ICT and security risk management for financial institutions. DORA incorporates and builds upon these guidelines, creating a mandatory regulatory framework that financial entities must follow. This alignment helps streamline compliance efforts and ensures consistency in cybersecurity practices.

- Payment Services Directive 2 (PSD2): PSD2 enhances consumer protection and promotes innovation in payment services. DORA complements PSD2 by requiring payment service providers to implement robust cybersecurity measures, ensuring the resilience and security of payment infrastructures.

Digital Operational Resilience Act: Challenges and Considerations

While the Digital Operational Resilience Act (DORA) brings numerous benefits, its implementation is not without challenges. Financial entities must navigate various hurdles to achieve DORA compliance and adapt to the cultural shifts required for successful adoption.

Implementation Challenges of DORA

- Complexity of Compliance: The DORA regulation introduces a comprehensive framework that requires significant changes to existing cybersecurity and operational resilience practices. Financial entities must invest time and resources to understand what is DORA and to align their processes with the new requirements. This complexity can be particularly challenging for smaller organizations with limited resources.

- Resource Allocation: Achieving compliance with the Digital Operational Resilience Act (DORA) often necessitates substantial investments in technology, personnel, and training. Organizations must allocate sufficient resources to enhance their cybersecurity infrastructure, implement robust risk management frameworks, and conduct regular testing, such as Threat Led Penetration Testing (TLPT).

- Integration with Existing Systems: Financial entities must integrate DORA’s requirements with their existing systems and processes. This can be a daunting task, especially for organizations with legacy systems that may not easily accommodate the new regulatory standards. Ensuring seamless integration while maintaining operational continuity is a critical challenge.

- Third-Party Risk Management: The DORA Act mandates rigorous oversight of third-party service providers. Financial entities must ensure their vendors and partners comply with the same high cybersecurity standards and operational resilience. It requires robust third-party risk management practices and regular assessments of vendor compliance.

Contact our experts to get advice on the best DORA compliance approach for your company.

Cultural Considerations

- Shift in Mindset: Successful implementation of the Digital Operational Resilience Act (DORA) requires a shift in organizational mindset. Financial entities must prioritize cybersecurity and operational resilience at all levels of the organization. This cultural shift involves fostering a security-first attitude and emphasizing the importance of compliance across all departments.

- Employee Training and Awareness: To meet the DORA compliance requirements, organizations must invest in comprehensive training programs for their employees. It includes educating staff on the new regulatory standards, best practices for cybersecurity, and the importance of operational resilience. Continuous training and awareness programs are essential to maintain a high level of preparedness.

- Collaboration and Communication: Effective collaboration and communication are crucial for DORA’s successful adoption. Financial entities must ensure that all stakeholders, including employees, third-party service providers, and regulatory bodies, are aligned with the new requirements. It involves transparent communication and a collaborative approach to addressing challenges and sharing best practices.

- Leadership Commitment: The successful implementation of DORA requires strong leadership commitment. CIOs, CISOs, and other senior leaders must champion the importance of DORA compliance and drive the necessary changes within the organization. Leadership support is critical to overcoming resistance and ensuring a smooth transition to the new regulatory framework.

Preparations for DORA (DORA Compliance Checklist)

Preparing for the Digital Operational Resilience Act (DORA) involves a thorough assessment of your organization’s current state and strategic planning to ensure compliance. Here are some guidelines and steps to help you navigate this process.

Assessing Readiness for the DORA Act

To evaluate your current state of readiness for the DORA regulation, consider the following guidelines:

- Conduct a Gap Analysis: Identify gaps between your current cybersecurity practices and the Digital Operational Resilience Act (DORA) requirements. This analysis should cover all key areas, including risk management, incident reporting, operational continuity, third-party risk management, and testing.

- Review Existing Policies and Procedures: Assess your existing policies and procedures to determine if they align with the DORA legislation. Ensure your organization’s cybersecurity and operational resilience protocols are up-to-date and comprehensive.

- Evaluate Technological Capabilities: Examine your current technological infrastructure to ensure it can support DORA’s requirements implementation. It includes evaluating your cybersecurity tools, data protection mechanisms, and incident response systems.

- Assess Third-Party Risks: Evaluate the cybersecurity practices of your third-party service providers to ensure they meet DORA compliance standards. It includes reviewing their risk management frameworks and conducting regular audits.

DORA Compliance Checklist

Once you have assessed your readiness, take the following steps to prepare for DORA compliance:

- Develop a Compliance Strategy: Create a detailed strategy that outlines the steps your organization will take to achieve compliance with the Digital Operational Resilience Act (DORA). This strategy should include specific actions, timelines, and responsibilities.

- Enhance Risk Management Frameworks: Strengthen your risk management frameworks to meet DORA’s requirements. It includes implementing continuous monitoring, conducting regular risk assessments, and updating risk mitigation strategies.

- Implement Robust Incident Reporting Mechanisms: Establish or upgrade your incident reporting systems to ensure timely and accurate reporting of significant cyber incidents. It will help you meet DORA’s incident reporting requirements and improve your response to cyber threats.

- Strengthen Operational Continuity Plans: Develop and maintain detailed plans to ensure the continuity of critical operations during and after a cyber incident. It includes disaster recovery and business continuity planning.

- Improve Third-Party Risk Management: Enhance third-party risk management practices to ensure service providers comply with DORA’s standards. It includes conducting regular assessments and audits of their cybersecurity practices.

- Conduct Regular Testing and Assurance: Implement regular testing and assurance activities, such as Threat Led Penetration Testing (TLPT), to identify and address vulnerabilities in your digital infrastructure. Continuous testing will help maintain a high level of cybersecurity readiness.

Conclusion

The Digital Operational Resilience Act (DORA) is crucial for enhancing cybersecurity and operational resilience in the EU financial sector. By understanding what is DORA and its framework, organizations can better prepare for compliance and strengthen their security.

DORA mandates stringent measures for risk management, incident reporting, operational continuity, third-party risk management, and regular testing like Threat Led Penetration Testing (TLPT). Compliance improves overall financial infrastructure security.

We at Iterasec specialize in guiding organizations through DORA compliance. We offer tailored strategies, assessments, and solutions to meet DORA requirements and enhance cybersecurity.

Contact Iterasec for expert guidance and support. We can help you navigate DORA implementation and ensure your organization remains secure and resilient against cyber threats. Reach out today to learn how we can assist you in achieving DORA compliance and improving operational resilience.